michigan unemployment income tax refund

These taxpayers should file an amended Michigan income tax return to claim that refund. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return.

Fetch Rewards Review Earn Rewards On Everday Grocery Purchases Earn Gift Cards Student Jobs Student Finance

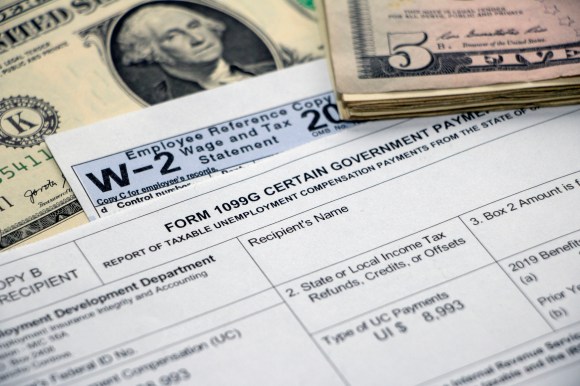

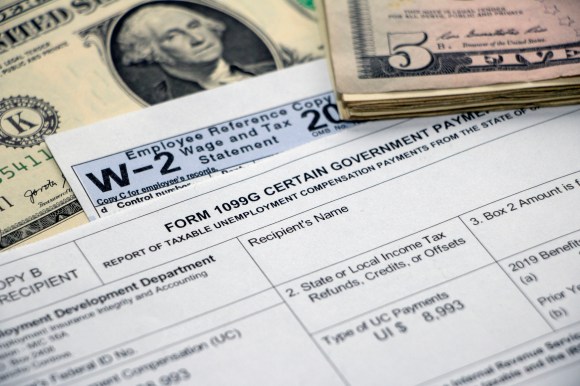

Total unemployment compensation is reported on Line 7 of the federal Form 1040 Schedule 1.

. The Michigan Department of Treasury will prioritize the processing of these amended returns in an effort to get this relief to taxpayers as soon as possible. 100 of unemployment compensation is included in total household resources and household income. In the latest batch of refunds announced in November however the average was 1189.

BFS will send you a notice if an offset occurs. Taxpayers who filed an original return and either claimed a refund or paid with their return will need to file an amended return to claim their entitled refund. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

The remaining 57 billion represents claims that were later ruled ineligible due to rule changes UIA error or other reasons. Michigans state income tax is 425. Please allow the appropriate time to pass before checking your refund status.

If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. Nearly 4 billion of that an audit determined. You pay tax in your home state only.

Federal tax rates are much higher between 10. There are two options to access your account information. Michigan residents who paid taxes on unemployment benefits in 2020 must file an amended tax return with the state in order to get that money back.

You can check your refund status online. Please enable JavaScript to continue using this application. An independent report published late last year found Michigan paid 85 billion in fraudulent or intentional misrepresentation unemployment payments.

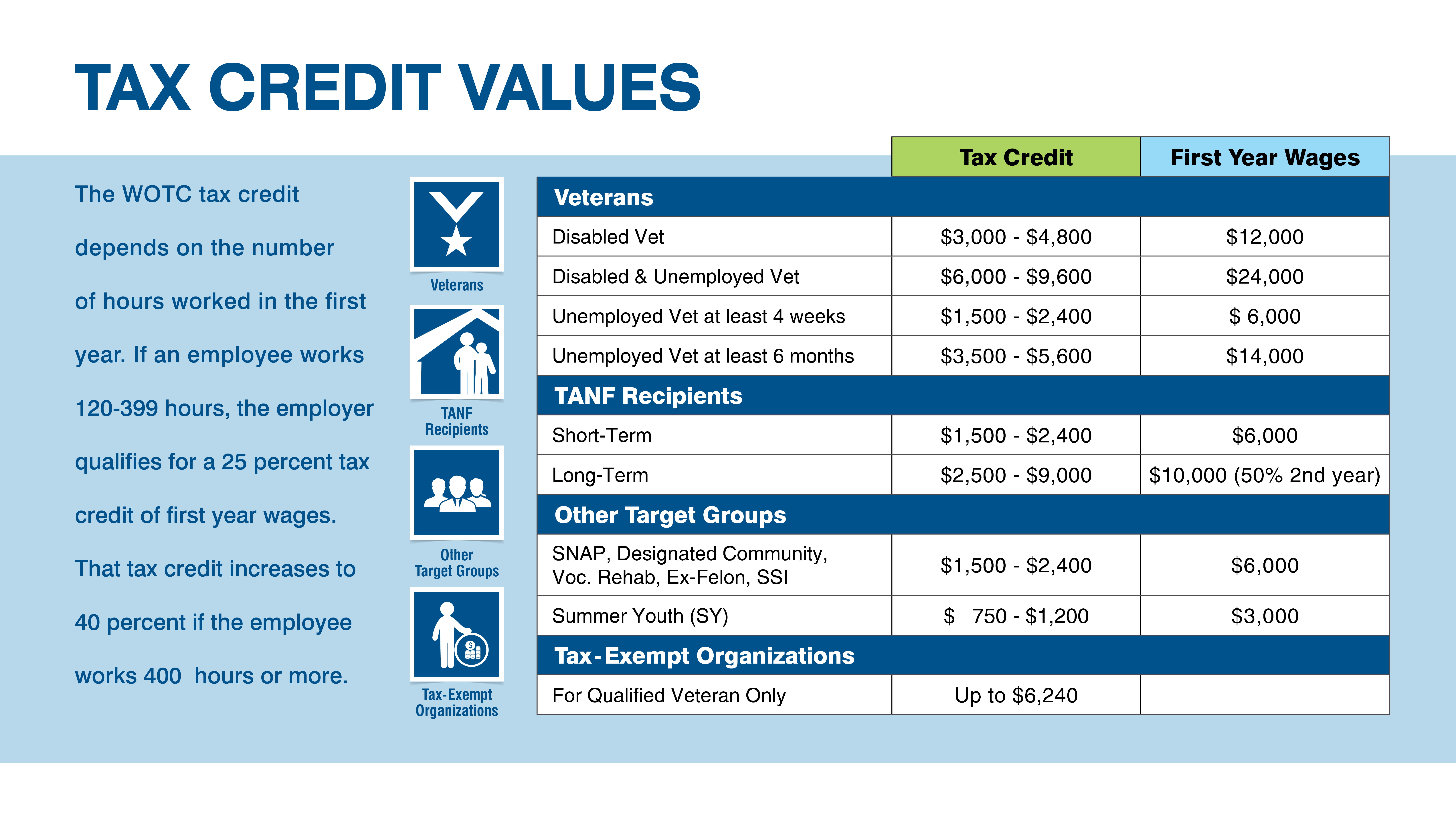

Michigan taxpayers who have yet to file their 2020 tax returns and wish to take the unemployment compensation exclusion do not need to wait to file. The unemployment compensation exclusion may possibly reduce tax liability for some taxpayers subject to their deferred payments and could even eliminate the payment completely. Unemployment Insurance Taxes Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year.

Tax filers need to report the exact dollar amount they received for unemployment compensation last year on their 2021 federal income tax return. If you use Account Services select My Return Status once you have logged in. Account Services or Guest Services.

Individuals who owed tax on their original return may have deferred their tax payments to a later date such as the Michigan extended filing date May 17 2021. During the pandemic federal law was changed so. That means the average refund for one week of unemployment from last spring and summer would be roughly 40.

And yes that unemployment compensation is treated. Allow 6 weeks before checking for information. The notice will reflect the original refund amount your offset amount the agency receiving the payment and the address and telephone number of the agency.

Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. Amending Individual Income Tax Returns Read the Update to April 1 2021 Notice Regarding the Treatment of Unemployment Compensation for Tax Year 2020. Under the rule change single taxpayers are able to exclude up to 10200 of unemployment benefits received in 2020 from taxable income on their federal returns or as much as 20400 for married.

Any portion of your remaining refund after offset is issued in a check or direct deposited as originally requested on the return. Be sure to check the box on Form MI-1040 line 31A and include any refund received from the original return and provide the explanation as to why the return is being amended. Without the 1099 workers are forced to make a choice between filing their tax returns without the 1099 and filing an amended one later which the US Treasury frowns upon or waiting and filing after they receive it Lisa Ruby public benefits attorney at the Michigan Poverty Law Clinic which advocates for low-income residents told.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within certain income brackets providing tax relief on both federal and state income taxes.

Michigan taxpayers who filed individual returns and collected unemployment benefits in 2020 should consider filing an amended return for a tax relief benefit. Say Thanks by clicking the thumb icon in a post. The net taxable unemployment compensation from federal Form 1040 Schedule 1 is included in federal AGI and is carried over to the Michigan income tax return without the need for any further adjustment on the Michigan return.

Additional Income and Adjustments to Income and the exclusion is reported on Line 8. Taxpayers who may have anticipated owing taxes may now be entitled to a refund or a lesser payment. The states accounting shows 85 billion in unemployment benefits it shouldnt have paid since the start of the pandemic including 28 billion paid in fraudulent claims according to a recent audit.

You may check the status of your refund using self-service. Thats according to the Michigan Department of Treasury who say the American Rescue Plan Act excludes unemployment benefits up to 10200 dollars from income for tax year 2020 for those within. June 1 2019 236 PM No.

Leo How To Request Your 1099 G

Leo Work Opportunity Tax Credit

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or Th Bookkeeping Business Small Business Accounting Payroll Accounting

How To Claim Unemployment Benefits H R Block

Unemployment Benefits On 2020 Tax Returns Ey Us

Michiganders Receiving Unemployment Benefits Can Choose Online Option To Receive 1099 G Tax Form Cbs Detroit

Tax Returns Tax Return Powerpoint Word Chart

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Guide To Unemployment Taxes H R Block

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

2021 Unemployment Benefits Taxable On Federal Returns 13newsnow Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Feds Relax Rules For Workers Ordered To Repay Michigan Unemployment Benefits Bridge Michigan